SEO for banking can significantly boost your bank’s online visibility and attract more customers. In this article, we’ll cover essential strategies like keyword research, technical SEO, content marketing, and local SEO to help your bank excel in search engine rankings and achieve lasting growth.

Key Takeaways

- SEO is essential for banks to enhance their online visibility, credibility, and attract more potential customers by improving their search engine rankings.

- Effective SEO strategies for banks include keyword research, technical SEO optimization, and content creation, focusing on providing valuable and relevant information to target audiences.

- Local SEO, including optimizing Google Business Profiles and maintaining consistent NAP details, helps banks increase their visibility in local search results and attract more local customers.

Understanding SEO for Banks

SEO plays a pivotal role in fortifying a bank’s online presence and credibility, drawing potential customers, and paving the way for sustainable growth. In the competitive banking sector, a strong SEO strategy can differentiate your institution from others, making it more visible and appealing to prospective clients.

Securing high ranks in search results augments your bank’s visibility, and simultaneously projects an image of credibility and trustworthiness to consumers, thus bolstering your brand’s reputation and goodwill. SEO for banks focuses on the potential customer’s journey from need to conversion, ensuring that your bank is easily discoverable and valued by the audience.

What is SEO for Banks?

Boosting a bank’s visibility in search engine results necessitates the optimization of its online presence. It helps to improve the visibility of relevant financial services, products, and information. It is the strategic process of enhancing a bank’s visibility on search engines like Google, Bing, and Yahoo to attract more organic traffic and increase brand awareness.

By optimizing a bank’s website for search engine results pages, SEO efforts make the site more search engine-friendly, leading to an increase in organic traffic and an improvement in overall online performance.

Why Do Banks Need SEO?

In the highly competitive banking industry, SEO serves as an indispensable tool for banks to underscore their unique value propositions and offerings, thereby standing out among the competition. SEO strategies are designed to position banks as reputable, authoritative, and customer-centric institutions, leading to higher rankings on search engines like Google. This in turn helps in fostering lasting relationships with their audience.

Some benefits of implementing SEO strategies for banks include:

- Higher rankings on search engines

- Increased visibility and brand awareness

- Improved website traffic and lead generation

- Enhanced customer engagement and conversion rates

SEO-acquired leads have a high conversion rate of 15%, indicating the quality and effectiveness of these strategies for banks.

Furthermore, SEO aids banks in managing their online reputation, by accentuating positive content and mitigating the impact of negative information. It is a long-term strategy that provides lasting benefits, including ongoing organic traffic and improved online visibility. Smaller banks can also leverage strategic SEO investments to rival the top megabanks in domain authority.

Banks, as a type of financial institution, need to proactively tweak their digital strategies to stay relevant and accessible to their target audience, ensuring they provide top-notch banking services.

Building an Effective SEO Strategy for Banks

The construction of an effective SEO strategy for banks encompasses several key steps such as keyword research, technical SEO, and content creation. A comprehensive SEO strategy is essential for improving a bank’s online presence, making the bank more visible, and attracting more potential customers. Setting clear, measurable goals for the SEO campaign is important to track progress and ensure alignment with long-term objectives.

For optimal performance, each page on the bank’s website should center around a primary keyword and ideally integrate related secondary keywords, including long tail keywords.

Keyword Research and Optimization

Keyword research and optimization involve:

- Identifying and targeting the keywords that the audience uses when searching for financial services

- Using tools like Ubersuggest, Ahrefs, and SEMRush to identify keywords with good search volume and low competition

- Conducting competitive analysis to understand what keywords competitors are successfully using, revealing new keyword opportunities and content ideas.

Crafting content that is bespoke to ideal customers aids in addressing their specific needs, alleviating common pain points, and imparting valuable insights, which cumulatively drive more organic traffic to the bank’s website. By focusing on relevant keywords, banks can improve their search engine rankings and increase online visibility.

Technical SEO for Banking Websites

Technical SEO concentrates on the optimization of a bank’s website structure, to render it more accessible to search engine crawlers. This can improve the website’s visibility in search results. Proper crawling involves optimizing the site structure, using sitemaps, and ensuring all important pages are accessible. Addressing technical SEO issues such as fixing canonical problems and maintaining consistent page indexation is essential for banks.

Using structured data can help Google understand your content better and increase search visibility through rich snippets.

Content Creation and Marketing Strategy

The creation and marketing of content are vital for banks to offer valuable and informative material to their customers. Creating unique, creative, and useful content on a banking website generates more traffic and enhances the bank’s online reputation. Banks should create in-depth guides on their blogs to position themselves as reliable sources of financial education and advice, fostering trust and loyalty among customers.

Moreover, the creation of multimedia content such as infographics and videos can captivate customers and relay complex financial information in a more comprehensible manner. Mapping content goals helps align content with specific objectives like raising awareness or driving applications for loans. Topic clusters, which involve grouping related content around a central pillar page, can enhance topical authority and improve search rankings.

Enhancing Local SEO for Banks

Local SEO proves to be fundamental for banks in drawing customers from specific geographic locales and enhancing visibility in local search results. By focusing on location service pages and utilizing local keywords, banks can significantly improve their visibility and provide personalized experiences for the local community.

Local SEO strategies also include optimizing local citations, garnering customer reviews, and ensuring consistent NAP details across all platforms.

Optimizing Google Business Profile

The optimization of your Google Business Profile is critical in bolstering visibility in local search results, along with providing analytical insights and customer reviews. Here are some key steps to optimize your profile:

- Verify your profile.

- Add important keywords to your profile description.

- Include high-quality photos of your bank’s interior and exterior.

- Encourage customers to leave reviews on your profile.

By following these steps, you can make your profile more appealing to potential customers and increase engagement with your business. Businesses with photos on their Google Business Profile receive significantly more requests for driving directions and click-throughs to their website.

In recent years, there has been a significant increase of over 60% in search queries for ‘bank near me’. This highlights the growing importance of local SEO for businesses in the banking industry. By ensuring your Google Business Profile is fully optimized, you can attract more local customers and improve your bank’s online presence.

Consistent NAP Details

The consistent upkeep of NAP details across all online platforms is vital for amplifying local SEO. It also helps in establishing a credible online presence. Inconsistent NAP details can create confusion among customers and negatively impact local search rankings as search engines struggle to verify the business’s legitimacy.

Location-Based Service Pages

The establishment of dedicated service pages for each bank branch can aid in capturing local search traffic, by customizing content to cater to the specific needs and interests of each community. Developing geo-targeted service pages can enhance local visibility at a lower cost than traditional marketing. These service pages should include localized content, such as branch-specific offers, events, and testimonials from local customers.

Including local testimonials and case studies on location-specific pages enhances credibility and relevance to local searchers. By focusing on location-based service pages, banks can provide personalized and relevant information to their local customers, improving engagement and trust.

Advanced SEO Tactics for Banks

For banks, advanced SEO tactics comprise building high-quality backlinks, harnessing social media and paid ads, and monitoring and analyzing SEO performance. These techniques help banks enhance their online authority and drive more organic traffic.

By implementing advanced SEO strategies, banks can stay ahead of the competition and continuously improve their bank’s search engine rankings.

Building High-Quality Backlinks

The construction of high-quality backlinks is crucial in boosting a bank’s search engine rankings and cementing its online authority. Banks can acquire valuable backlinks by:

- Writing guest posts

- Forming partnerships

- Leveraging unlinked brand mentions

- Engaging in comprehensive competitive analysis to reveal new opportunities for backlink acquisition.

Leveraging Social Media and Paid Ads

Complementing SEO efforts, social media and paid ads can drive targeted traffic towards high-quality content and offer immediate visibility. Strategically using paid ads to rank on search engines can help content gain visibility and lead to more backlinks due to the boosted traffic and exposure.

By leveraging social media and paid ads, banks can enhance their overall digital marketing strategy and attract more potential customers.

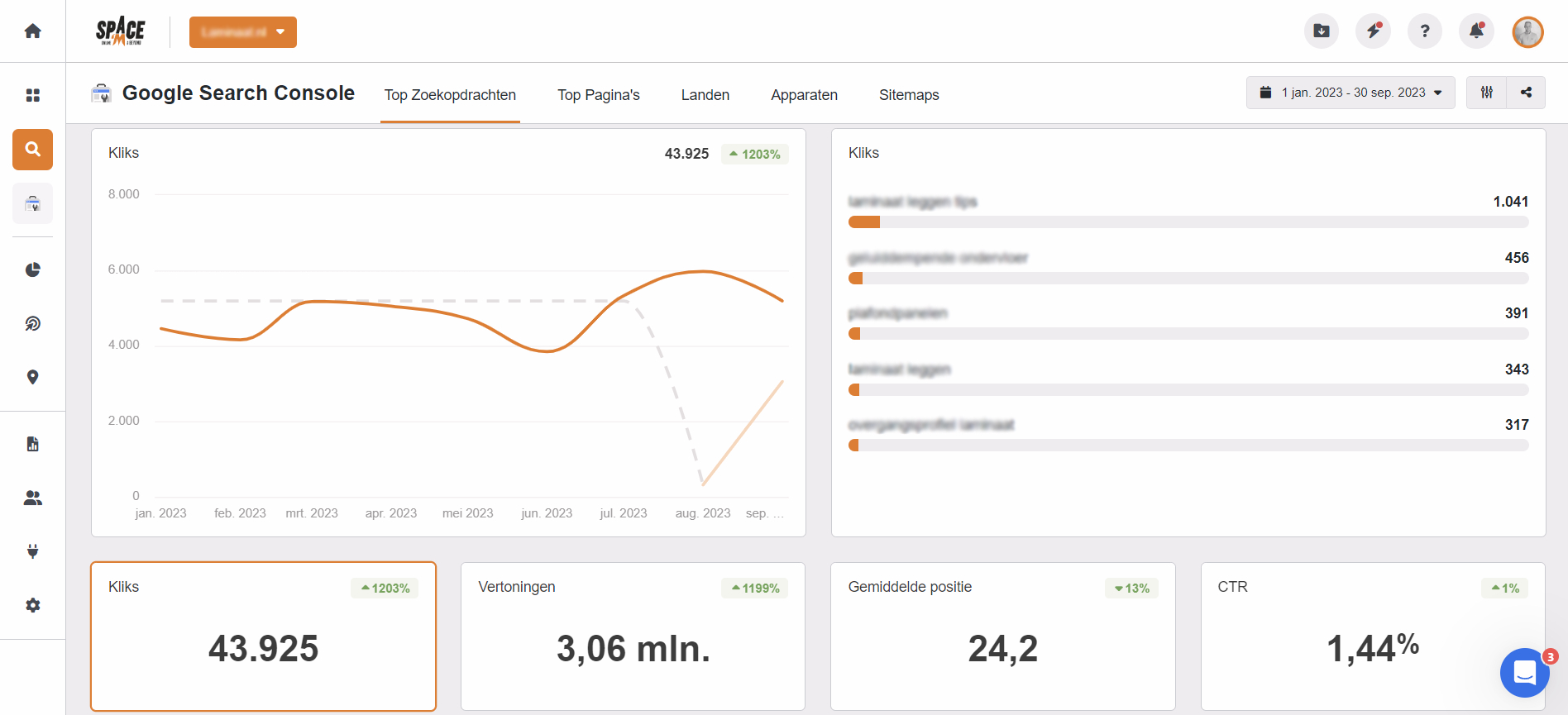

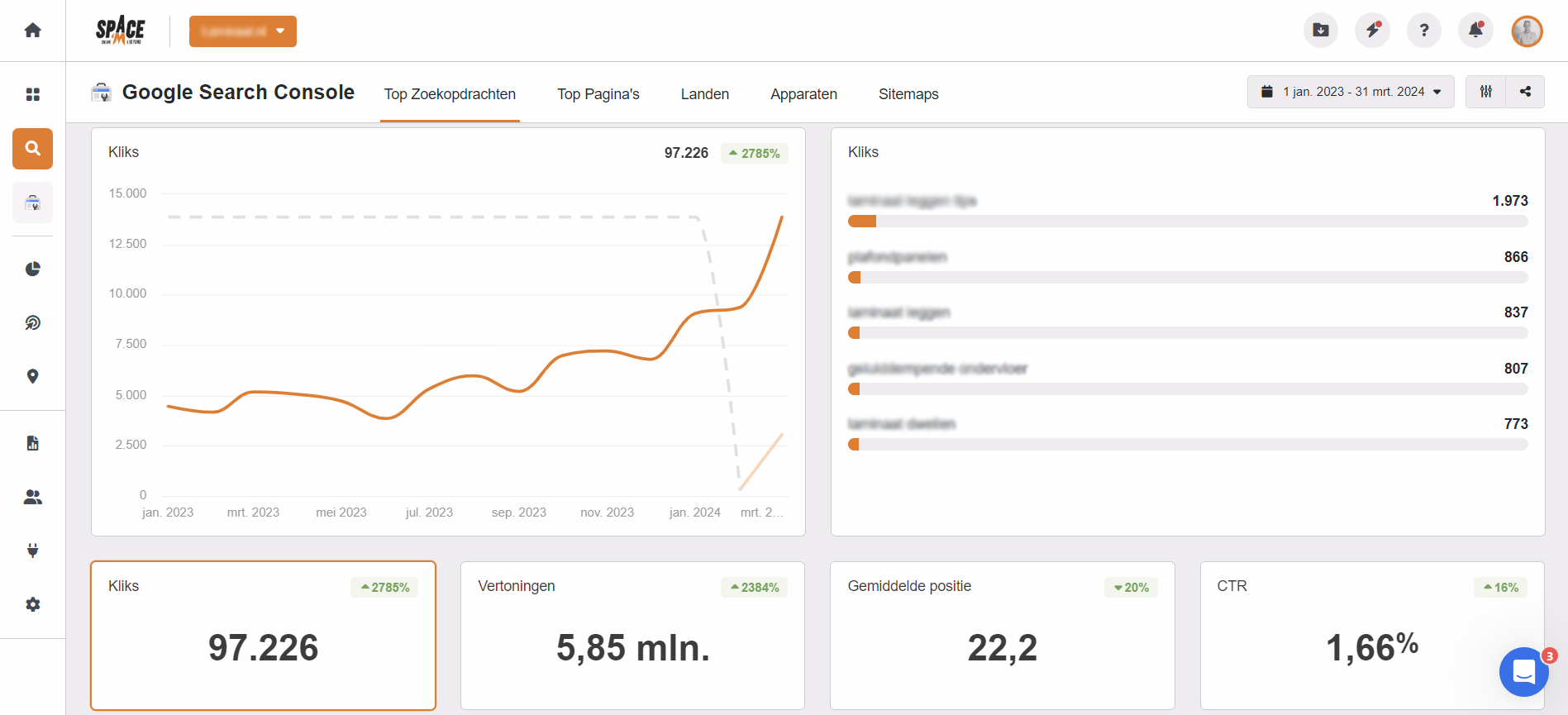

Monitoring and Analyzing SEO Performance

The monitoring and analysis of SEO performance can assist banks in finetuning their strategies and staying abreast of evolving SEO trends. Here are some ways to optimize your SEO performance:

- Use analytics tools to track keyword performance and identify crawl errors

- Optimize how search engines navigate your site

- Improve overall SEO efficiency

By implementing these strategies, you can improve your bank’s SEO performance and attract more organic traffic to your website.

Engaging in ongoing SEO monitoring and adjustments is critical to securing a high rank in search engine results.

Improving User Experience on Bank Websites

Enhancement of user experience on bank websites requires a mobile-first design, streamlined navigation, and accessibility to accommodate diverse user needs and preferences. A well-designed user experience can enhance customer satisfaction and loyalty, leading to increased website traffic and conversions.

Mobile-First Design

A mobile-first design guarantees:

- Accessibility across various devices and screen sizes

- Enhanced visibility and user experience

- Higher ranking on Google, as it uses the mobile version of a website for indexing

Optimizing for performance and speed on mobile devices is essential, as many users conduct banking activities via mobile.

Streamlined Navigation and Accessibility

Streamlined navigation and accessibility facilitate easy access to information, thereby boosting user satisfaction and loyalty. Using clear, large buttons and smooth gesture-based navigation can make interactions on mobile banking apps more intuitive.

Ensuring consistency in user experience across mobile and desktop platforms enhances usability for customers who transition between devices.

Long-Term Benefits and ROI of SEO for Banks

The long-term benefits and ROI of SEO for banks include:

- Sustainable growth facilitated by organic traffic

- Cost-effectiveness when compared to traditional advertising

- Compounding results over time, leading to exponential growth in traffic, conversions, and revenue.

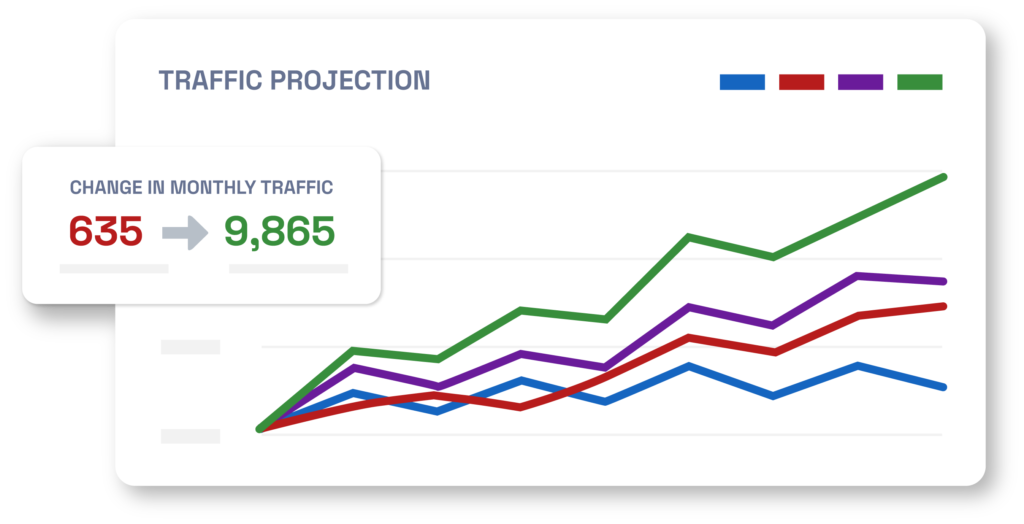

Sustainable Growth Through Organic Traffic

Investments in long-term SEO strategies culminate in increased organic traffic, elevated conversion rates, and ultimately, a larger customer base. SEO is not a quick fix, as it takes time to see its effects. Usually, results start appearing within 3-6 months, but the full impact can take even longer to become apparent.

By building relevant content and authority, banks can achieve consistent organic growth, as illustrated by the 37% traffic growth seen by Canvas Credit Union through sustained SEO efforts.

Cost-Effectiveness Compared to Traditional Advertising

Compared to traditional advertising, SEO offers several advantages:

- It is more cost-effective, as it reduces the dependency on costly paid ads over time, while organic traffic continues to grow.

- SEO clicks can cost 50-80% less than paid search ads, making it a more economical source of new business.

- By focusing on organic search results, banks can achieve a higher ROI while minimizing ongoing ad spend.

Common SEO Challenges for Banks and How to Overcome Them

The surmounting of common SEO challenges for banks entails:

- Keeping up-to-date with SEO trends

- Managing the online reputation

- Differentiating themselves in a competitive landscape

- Focused keyword strategies

- Content tailored to unique customer needs

Frequent algorithm updates can significantly impact search rankings, making it essential for banks to stay informed about the latest SEO trends and best practices.

Staying Updated with SEO Trends

Keeping abreast of SEO trends enables banks to maintain their competitive edge and adapt to changes in algorithms. Regularly updating content to align with the latest SEO trends can help banks stay relevant.

Participating in industry webinars and SEO conferences can provide valuable insights and keep banks informed about the latest trends and algorithm changes.

Managing Online Reputation

The management of online reputation necessitates the following actions:

- Monitoring and responding to online reviews, to uphold a positive brand image

- Regularly monitoring your online presence to quickly address any potential reputation issues

- Responding to customer reviews on your Google Business Profile to illustrate that your bank values customer feedback and can positively influence potential customers.

Promptly and professionally addressing negative reviews helps mitigate their impact on a bank’s reputation.

In what other industries does Space’M Online SEO?

Space’M Online extends its SEO expertise across a diverse range of industries beyond finance, legal, insurance, and e-commerce. Our team is adept at crafting tailored SEO strategies for sectors such as healthcare, education, real estate, and technology.

By understanding the unique challenges and opportunities within each industry, we help businesses enhance their online presence, drive targeted traffic, and achieve sustainable growth. Whether you’re a local business or an international enterprise.

Space’M Online is committed to delivering results that align with your specific industry needs and goals, take a look at the following industry page to get more information:

Frequently asked questions

We recognize that you might have inquiries about our SEO services for banks or banking companies and our modus operandi. Here are some frequently asked questions to help clarify our approach and the benefits of partnering with Space’M Online:

Why is SEO important for banks?

SEO is crucial for banks as it improves online visibility, attracts potential customers, and builds trust and credibility. An effective SEO strategy can set a bank apart from its competitors and drive sustainable growth through organic traffic.

How long does it take to see results from SEO efforts?

You can expect to see noticeable results from your SEO efforts within 3 to 6 months, though the full impact may take even longer as results compound over time for continued growth.

What are some effective keyword research tools for banks?

Some effective keyword research tools for banks are Ubersuggest, Ahrefs, and SEMRush. These tools can help identify keywords with good search volume and low competition, offering valuable insights for targeting relevant keywords.

How can banks improve their local SEO?

To improve their local SEO, banks can optimize their Google Business Profile, maintain consistent NAP details, and create location-based service pages with localized content and testimonials. This will help enhance their online visibility and attract more local customers.

Why is mobile-first design important for banking websites?

Mobile-first design is important for banking websites because it ensures accessibility across different devices and screen sizes. It also improves visibility and user experience, as Google uses the mobile version of a website for indexing, and responsive websites are ranked higher.